Because we are a Catholic public charity serving Catholics, our Board of Trustees is committed to investing our entire endowment portfolio according to the ethical, moral and social teachings of the Catholic Church. Without applying Catholic screens, secular investments would support companies that promote abortion, contraception, fetal stem cell research, human trafficking, child labor, pornography and other sinful causes. By applying Catholic screens to the ICF portfolio, our investments protect human life, promote human dignity, enhance the common good, pursue economic justice and care for God’s creation.

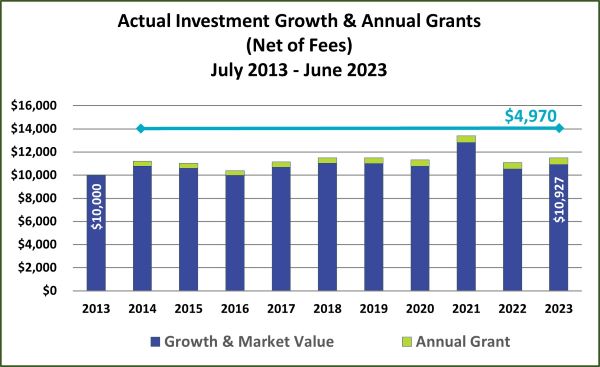

Some would argue that Catholic screens reduce earnings, but our historical returns prove this to be false. In the 10-year period ending September 30, 2023, our 5.8% annualized returns net of fees matched the secular benchmarks. We will never apologize for prioritizing faith over returns.

Our Catholic screenings comply with the US Conference of Catholic Bishops socially responsible investment guidelines that are available for review here. You may also download our printed narrative at the bottom of this page.

Our commitment to faith-based investment practices is another reason why the Independent Catholic Foundation has become the preferred steward of many parishioners’ legacies throughout Central Pennsylvania.